What is customer retention, and why is it important?

Customer retention is a metric that expresses a company's ability to retain its existing customers over a certain period, which is usually one year. It quantifies the percentage of customers who continue to do business with the company, use its products or services, or remain engaged over time.

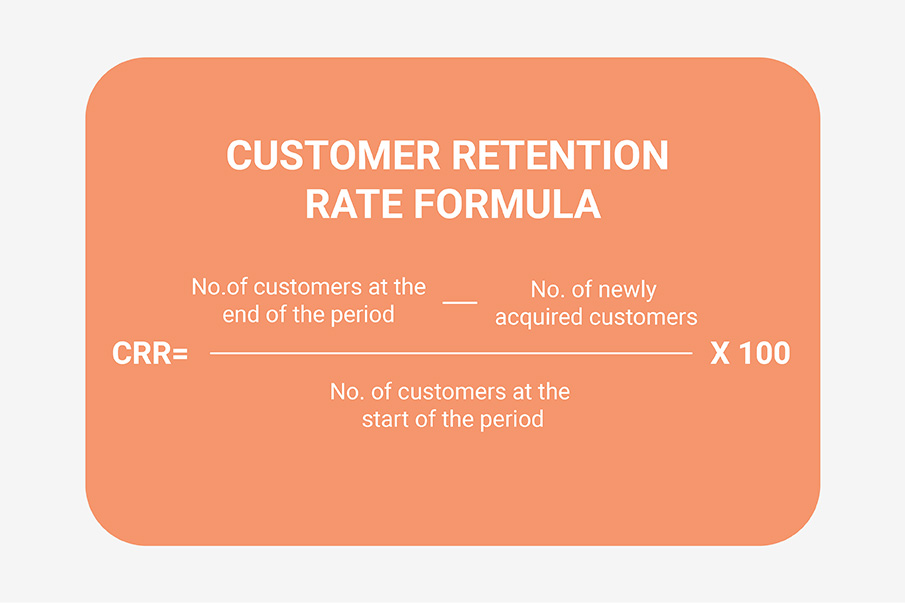

Here’s the formula for calculating customer retention rate:

A quick glance at the formula indicates the utmost importance of keeping this number as high as possible. The concern over potential financial losses extends beyond simply having fewer customers at the end of the year, because the acquisition of a new customer costs multiple times more than retaining the existing one. So losing a customer doesn’t just mean that the company’s missing out on future revenue from that specific customer. It’ll also generate a whole lot of additional expenses to find another one.

Finally, poor customer retention signals issues with customer loyalty, brand trust, and an overall negative reputation that can inflict extensive long-term damage on your business.

Why do customers stay or walk away?

Quality as the top driver of brand loyalty

Numerous factors can cause customers and clients to drift away from a brand, but it’s not always easy to pinpoint one key reason, even for the customers themselves. It may be about the value for money, customer support, or security, or it may be they switched simply because they’ve found a better alternative. And sometimes, or rather often, it really boils down to the quality of the product. Actually, when asked about what inspires loyalty to a brand, consumers put product quality at the top of the list by a considerable margin.

Now, in terms of software products, quality may be an even more delicate issue. Here, quality is a broad term that includes, above all, functionality, reliability, usability, efficiency, and maintainability of the system. Even companies that don’t offer digital products or services still have to rely on some sort of digital products or services to support their business, so upholding high quality standards is a must if they wish to protect their reputation.

The rising pressure for flawless software quality

Increasingly high expectations from digital products are becoming the norm in the market, echoing a strong attitude that the end-users have developed towards quality issues over time. As much as 20% of consumers say that they’re ready to never shop with a brand again if they encounter one error, while 90% of users reported to have stopped using an app because of bad performance.

In the era of extremely high standards for software quality, these statistics come as no surprise, and in the future, we can expect consumer habits to change and evolve continuously, pushing the market even further forward. There’s an ever-present pressure to deliver flawless software, and there’s no mercy for functionality issues or even below-par UX, as more than 40% of users today believe that if a company offers a poor user experience, they won’t be able to deliver a quality product either.

Why quality is non-negotiable in high-stakes industries

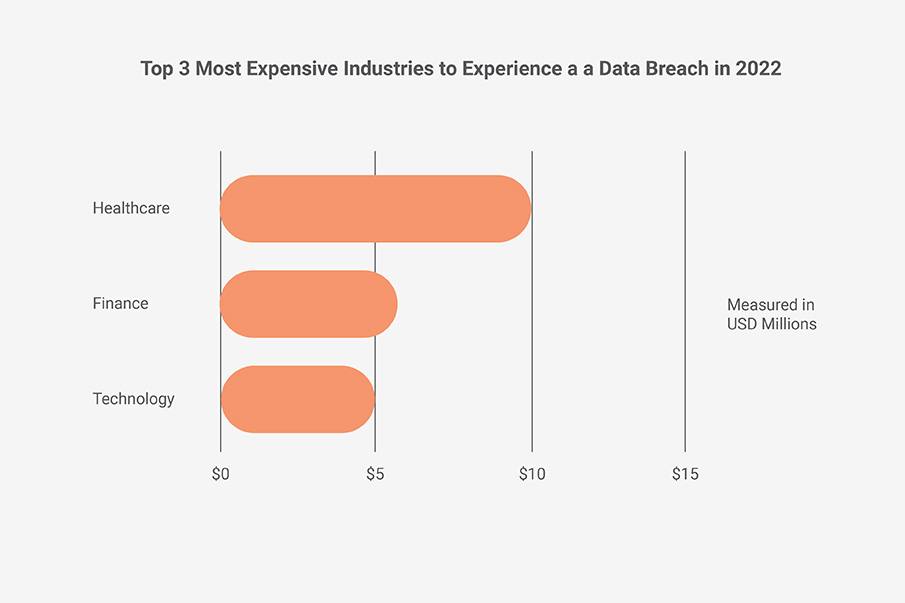

On the same token, we’ve seen brands take some hard hits exactly because of what may’ve seemed like small issues with the software they developed or used for business. The challenge gets more critical for businesses in high-risk sectors, such as banking, automotive, or healthcare, where the reliability and security of their digital systems and touchpoints are absolutely crucial.

In mobile banking, for instance, consumers’ biggest concern is their account getting hacked (46%), with the fear of getting locked out of their account coming in third. So, users understandably expect their banking app to be safe and functional, and with large and severe security breaches happening with alarming frequency, this statistic is hardly shocking.

One of the most prominent examples is Equifax, a major US consumer credit reporting agency. In a colossal cybersecurity accident in 2017, they suffered one of the biggest data breaches in history, with the private data of 147 million Americans exposed.

The incident ruined Equifax’s image and stock price and cost them over $700 million in legal settlements, fines, and associated expenses, with total costs running into billions of dollars. Moreover, it raised serious concerns about data security and privacy in the long run, particularly involving large corporations that handle massive volumes of sensitive personal information. However, the issue has only grown since, as back in 2017 the Equifax case was one of the 10 worst data breaches of all time, but currently it’s not even in the top 20 anymore.

Service disruptions and customer frustration

Of course, brands face financial and reputational risks even when the consequences of their oversights are much smaller than exposing the data of millions of people. In this respect, lack of stability and availability can be very annoying for users, as we can see in the example of the British Co-operative Bank, which left its customers fuming. After “only” three instances of downtime of the bank’s mobile app, each lasting for a few days, the clients began to publicly voice their frustration and threatened to close their accounts and switch banks.

We all know how annoying and troublesome it is when an app or service we depend on goes down unexpectedly, especially if it prevents us from doing business and completing transactions. We, as consumers, are now used to a certain standard and there’s no turning back or lowering the bar.

In part two of this article, we will explore how to build brand trust with the help of QA and highlight some of the best testing practices that can help in this area. And if you wish to know more about how Sixsentix’s services can ensure high-quality software to increase customer retention, contact us.